Bitcoin might rebound from recent lows due to growing liquidity as stablecoin issuers deploy $1.25 billion in USDT and USDC into the market.

With fading optimism about Donald Trump’s executive order on a national Bitcoin reserve and macroeconomic headwinds, the premier asset has lost bullish traction recently. BTC has consolidated below $100,000 for 14 consecutive days, dropping to $93,000 yesterday before a swift rebound.

Meanwhile, the lackluster price action correlates with a lack of whale activity on the Bitcoin network. Recent analysis shows that large holders of the premier asset have remained unusually quiet, neither buying nor selling.

A Rebound on the Horizon?

However, latest on-chain activity suggests Bitcoin may rebound from the recent shake-off. Market analytical firm Lookonhain highlighted positive activity among stablecoin issuers in the past day.

In a tweet, the firm disclosed that $1.25 billion worth of liquidity was injected into the crypto market in the past 24 hours. Remarkably, these deployments came from Tether and Circle, the two largest stablecoin issuers in the sector.

$1.25B worth of stablecoins minted in the past 24 hours.#Tether minted 1B $USDT on #Tron 4 hours ago.#Circle minted 250M $USDC on #Solana 12 hours ago.https://t.co/Ptsy2Bshz6https://t.co/KgLuFF8Num pic.twitter.com/Jyn1lJuFcQ

— Lookonchain (@lookonchain) February 19, 2025

Further analysis from Arkham shows that nine hours ago, Tether issued $1 billion worth of USDT on the Tron network. The prominent issuer has now issued $61.7 billion in USDT on Tron, expanding liquidity in the crypto market.

Meanwhile, Solscan shows that Circle issued $250 million in USDC on the Solana network, its second in two days. Notably, the second-largest stablecoin issuer has now minted $2.25 billion in USDC on the Solana network alone since the start of February.

This incessant stablecoin minting and deployment suggest that demand for stablecoins is on the rise. This could mean that market participants are preparing to massively buy the dip, which could spur a price rebound in the near term.

However, it could also indicate that investors are taking a cautious approach and liquidating their crypto holdings for stablecoins. The next few days would reveal which disposition market users are taking.

Miner’s Bitcoin Sales Dampening Market Mood

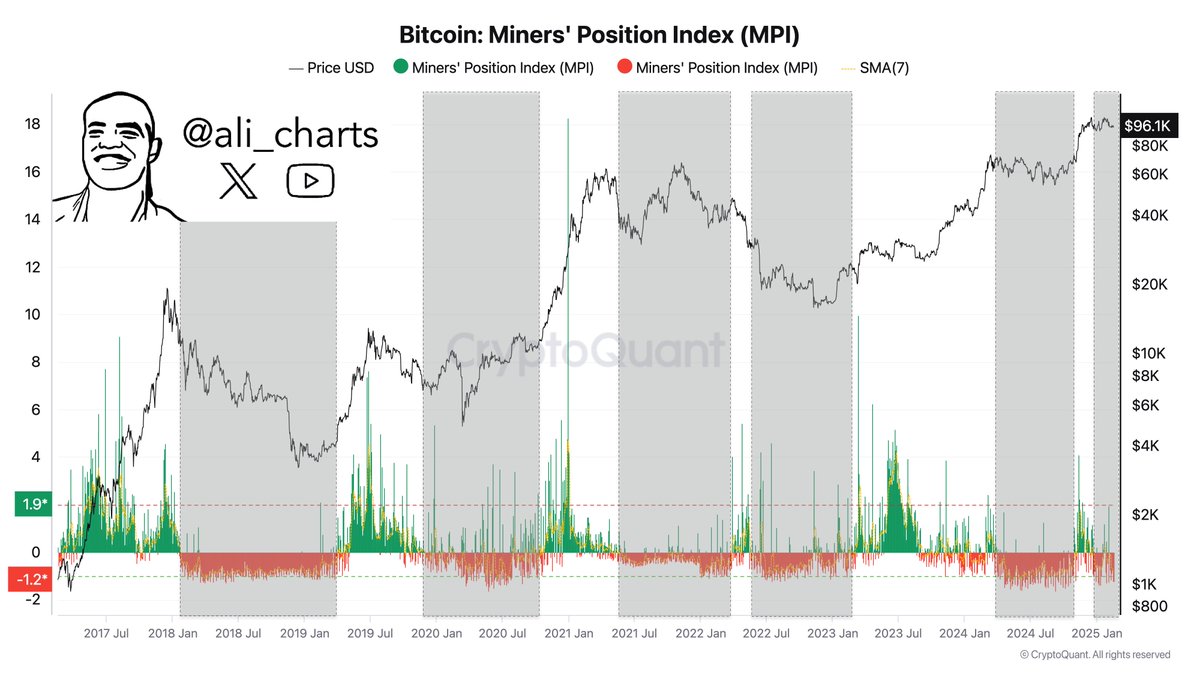

Meanwhile, Bitcoin miners’ recent activities have highlighted a cautious atmosphere. Miners of the pioneering cryptocurrency have increasingly sold their stash in the past week, substantially depleting their reserves.

For context, data shows that miners sold over 2,000 BTC in the past seven days, adding to their recent dumps. As of February 17, their reserve now holds approximately 1.81 million BTC.

Notably, an analysis reveals that a negative Bitcoin miners’ position index (MPI) usually precedes an intense market correction. The commentary suggests that unless the indicator changes, Bitcoin may correct further.

In the meantime, Bitcoin trades at $95,697, almost unchanged in the past 24 hours.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.